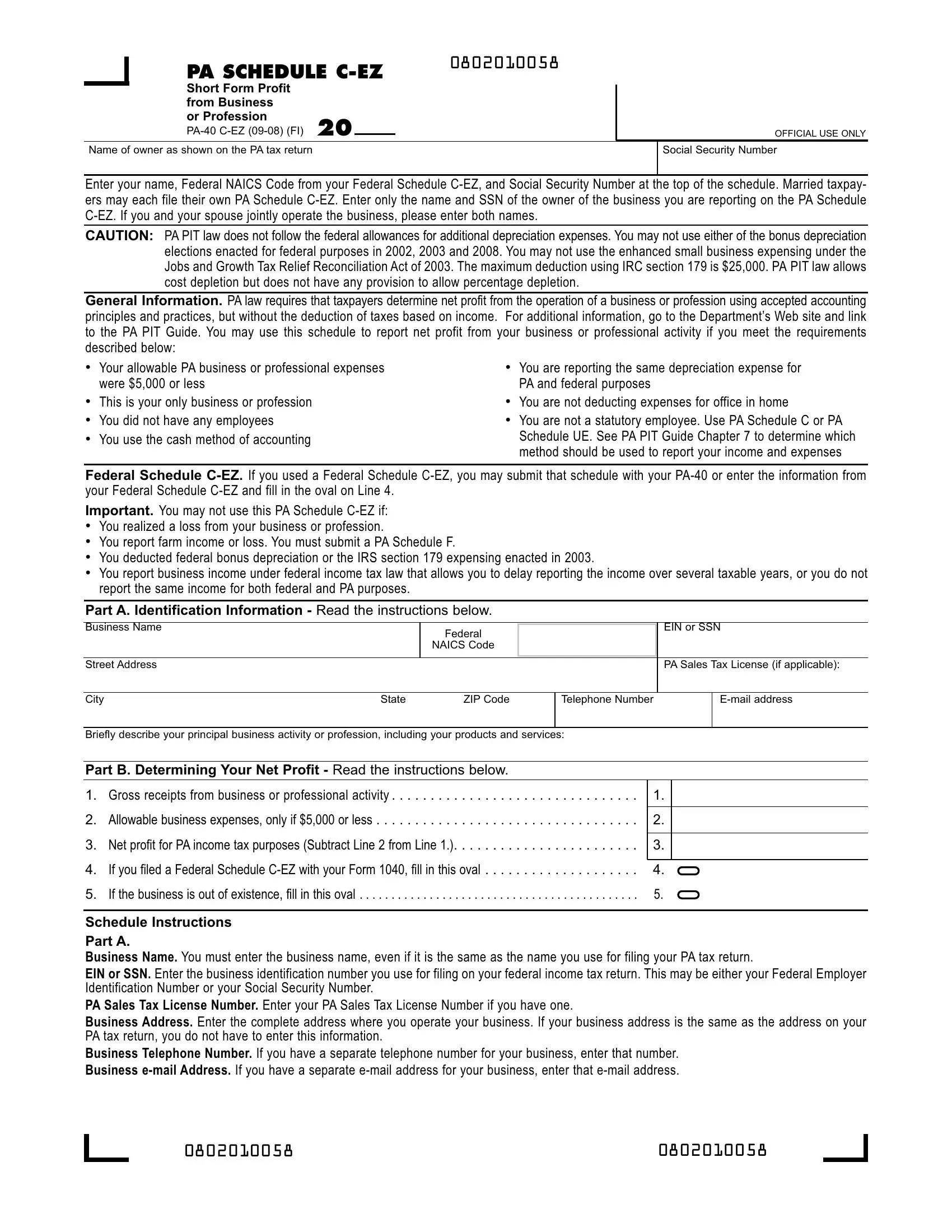

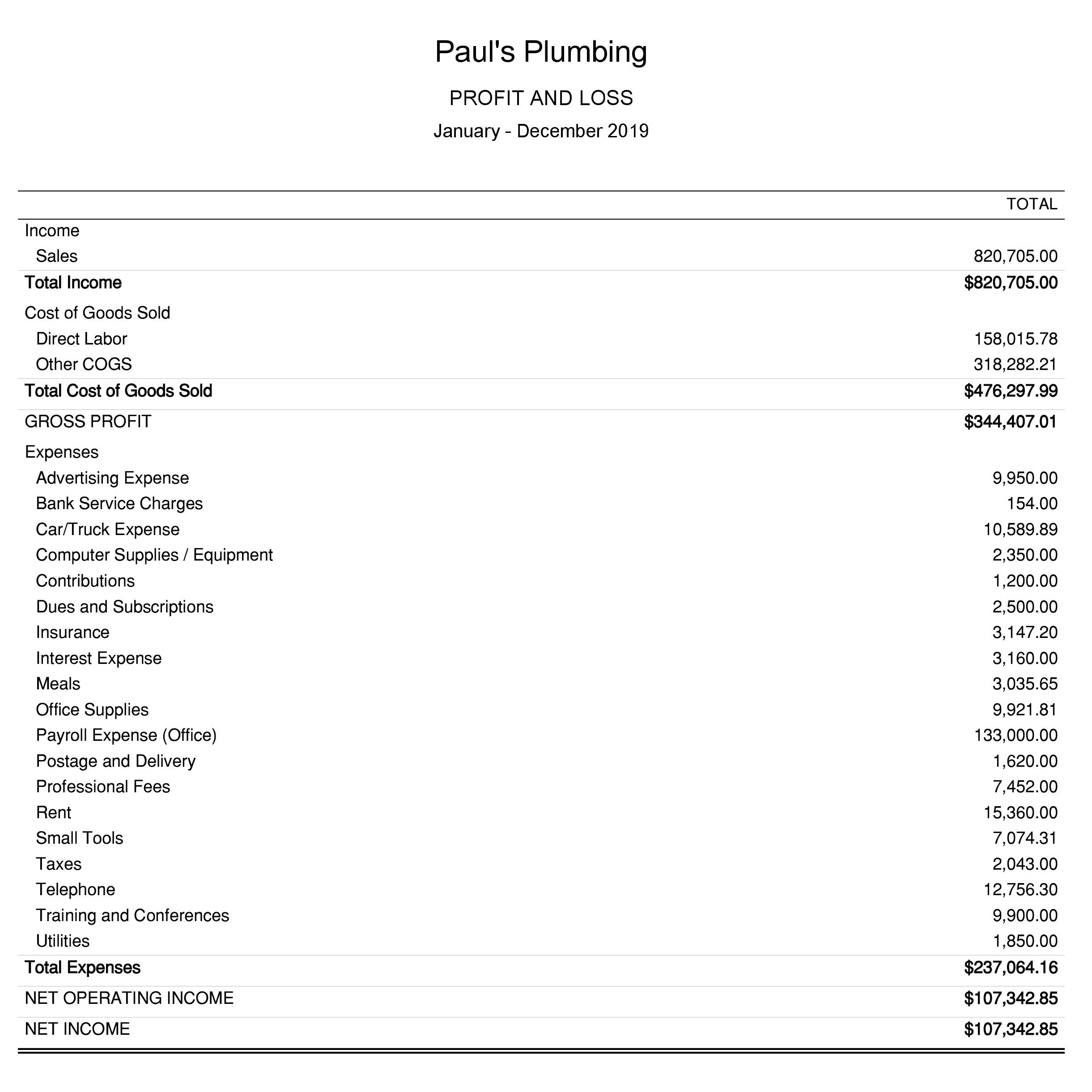

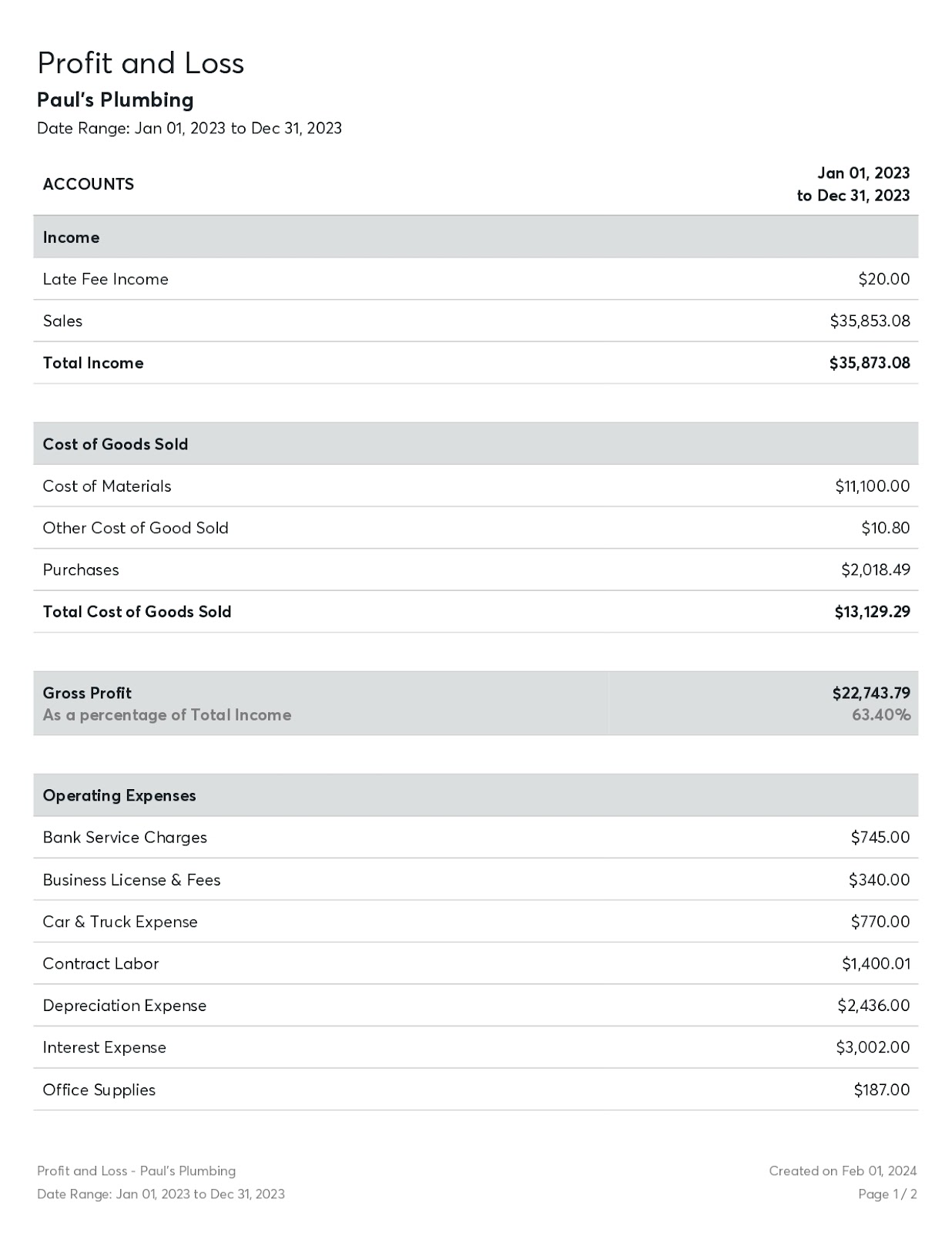

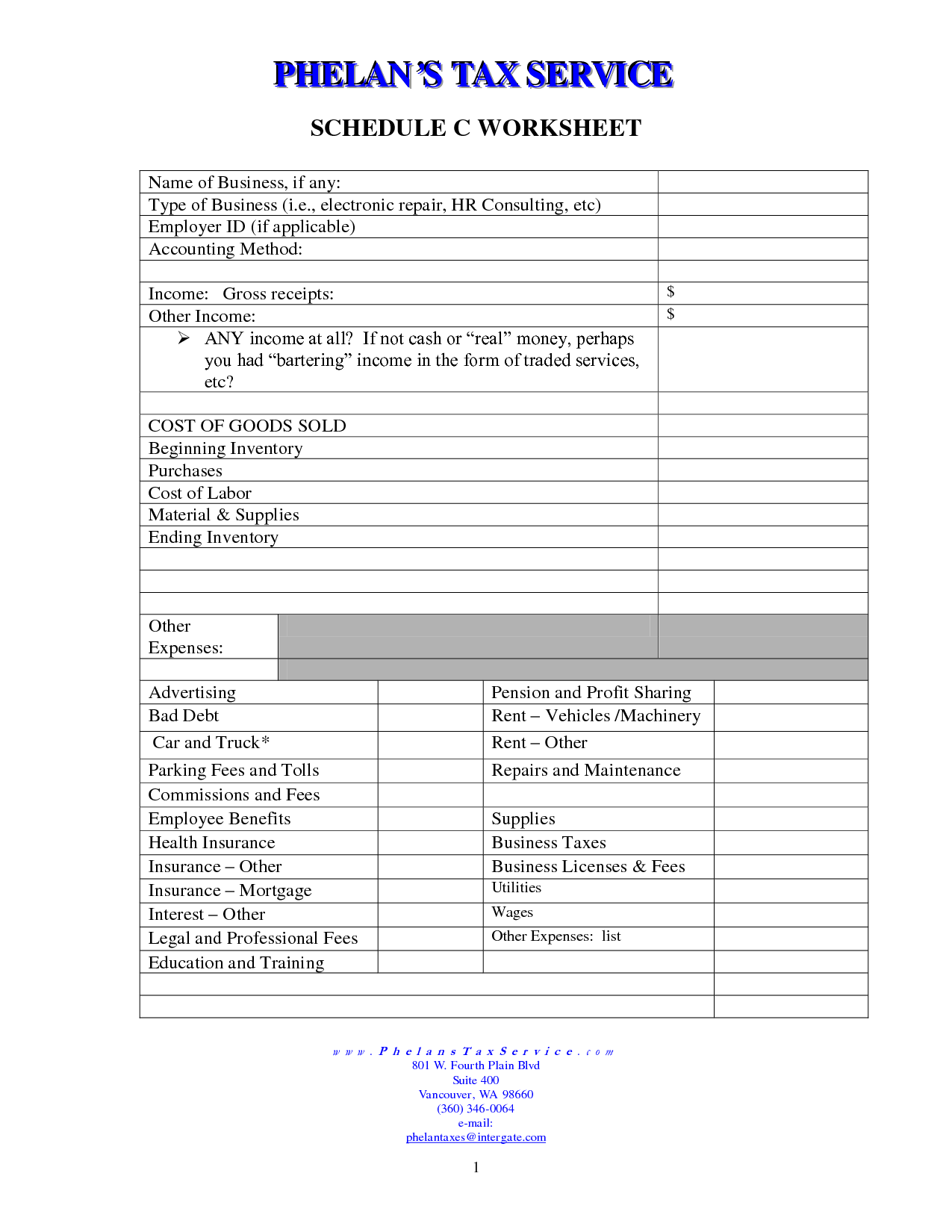

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Bedpages Boston

- Salem Statesman Journal Obituaries

- Dunhams Gun Warehouse

- Yasmine Lopez Twitter

- Utica Observer Dispatch Obituaries For Today

- Clarksville Ar Craigslist

- Downtown Gahanna Restaurants

- Asheville Citizens Times Obituaries

- Ranch World Ads Jobs

- Von Autopsy Photo

- Listcrawler Cle

- Susan Shapiro Wgal

- Gun Memorial Georgia

- Youtube Next Level Soul

- Perkins Glyph

Trending Keywords

Recent Search

- Comenity Easy Pay Burlington

- O Keefe And Merritt Oven Parts

- Comenity Victoria Secret Log In

- Obituaries Visalia

- Hurst Scott Funeral Home Richlands Va Obituaries

- Tristyn Bailey Autopsy Photos

- Ubloked Games 66

- South Central Regional Jail Daily Incarcerations

- Look Who Got Busted Comal County Busted Newspaper

- Facebook Marketplace Richmond Virginia

- Ts North Nj

- Evansville City County Observer Police Reports

- Publix Application Jobs

- Julie Banderas Swimsuit

- Jobs In Modesto Craigslist

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)