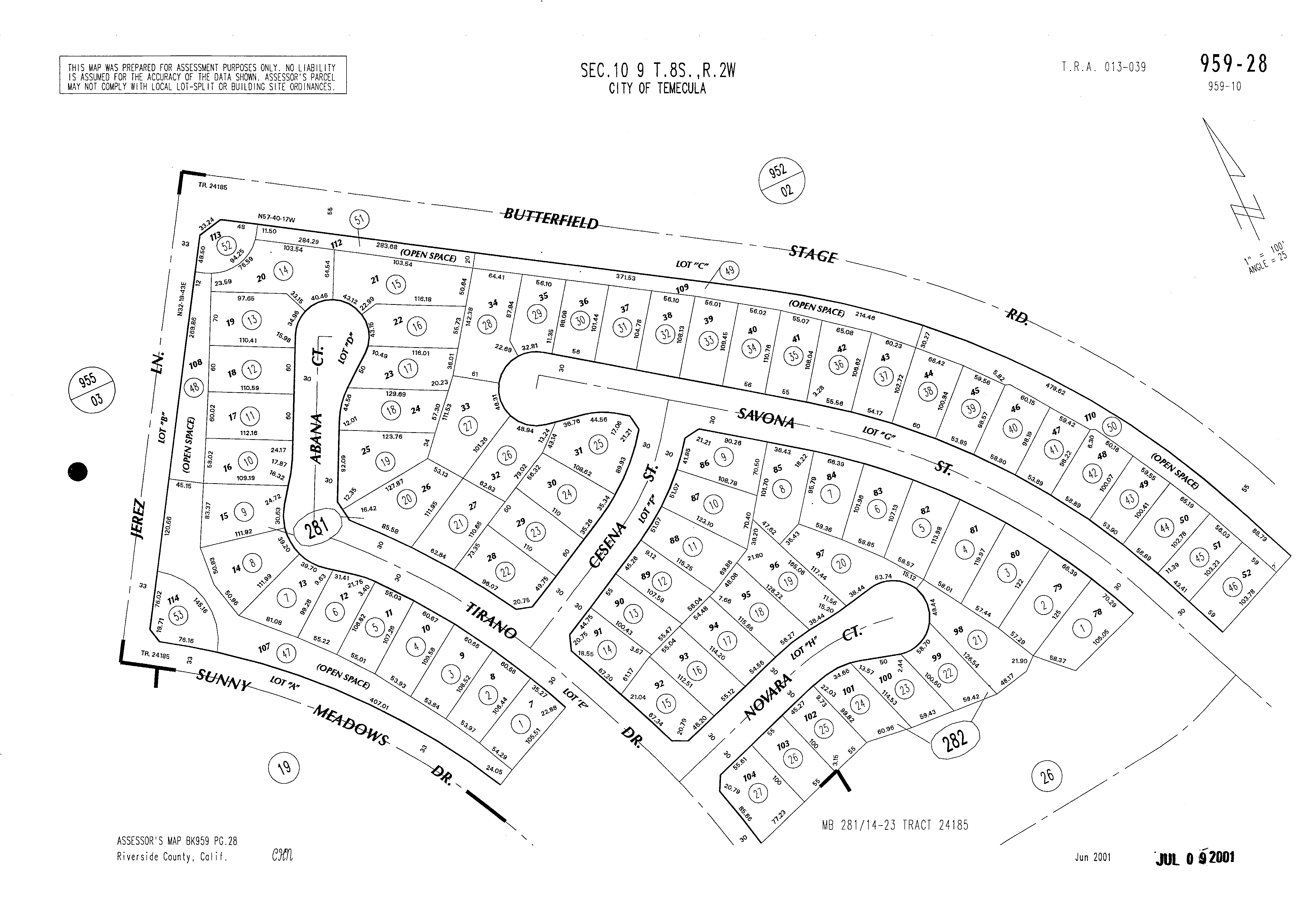

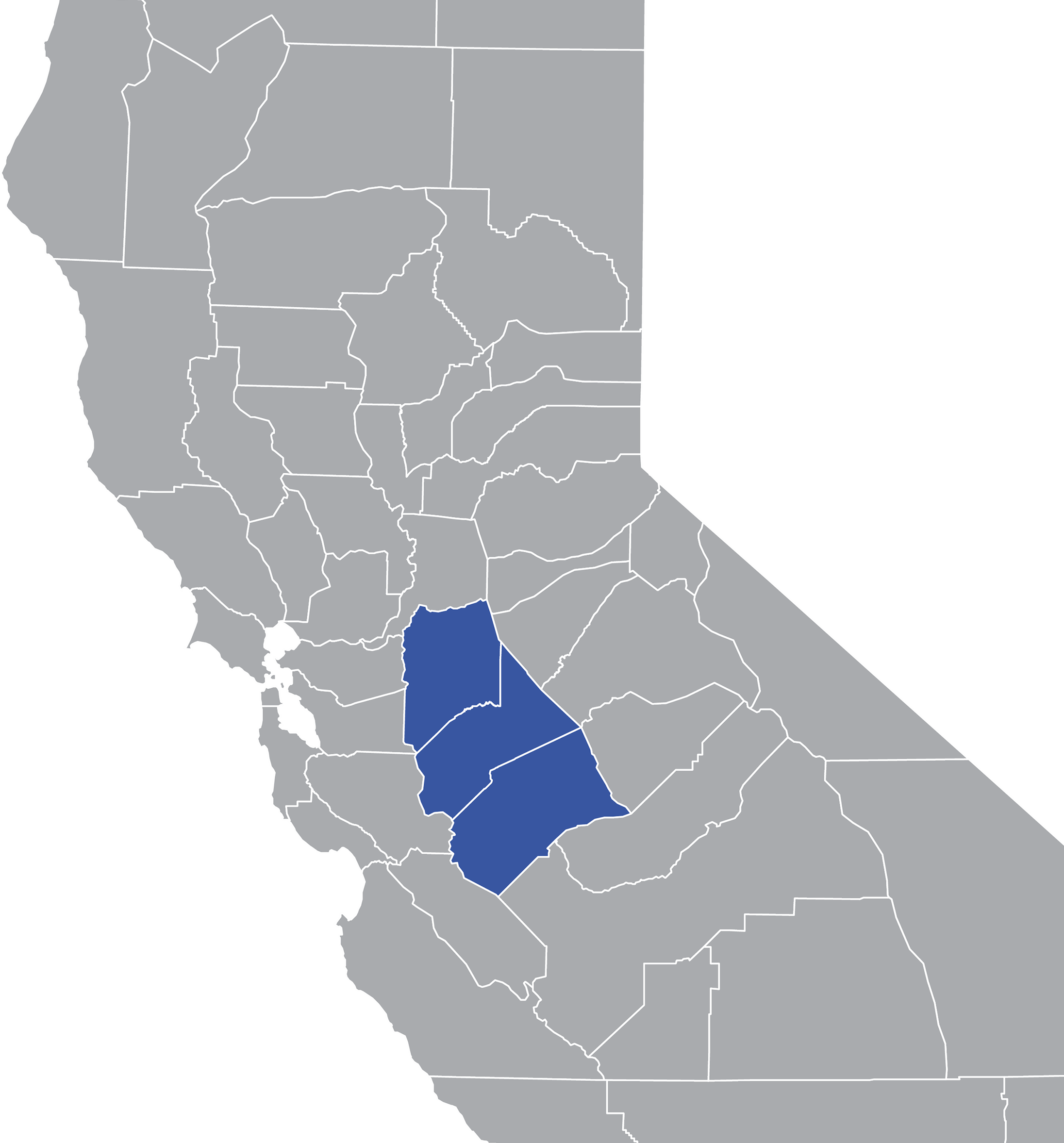

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Minnesota Valley Funeral Home

- Cash App Approval Link Not Working

- Cashwise Weekly Ad West Fargo

- Grandma Etsy

- Bakery In Safeway

- Lewis Smith Lake Alabama Homes For Sale

- Mcdonalds Crew Member Salary

- Unique Upper Arm Half Sleeve Tattoo Designs

- Richmond Active Calls

- Julie Green Ministries 2024

- Dispensary Hiring

- Fairfax County Building Permit Office

- Sitter Jobs Near Me

- Indian Motorcycle Forums

- Cactus Patches Osrs

Trending Keywords

Recent Search

- Horoscope Tango

- Devargas Funeral Home Of Taos Obituaries

- Stark Funeral Home Obituaries Milan

- Tyler Zed Parents

- Akron Beacon Journal Death Notices

- Uab Webmail

- Scopes At Dunhams

- Entry Level Data Entry Jobs

- 83k Salary To Hourly

- Sharon Tate Crime Scene Pictures

- Marketplace Facebook Pensacola

- Reading Eagle Newspaper Obituaries

- Lorain Morning Journal Obituaries

- Lookwhogotbusted Angelina County

- Joeitel

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)