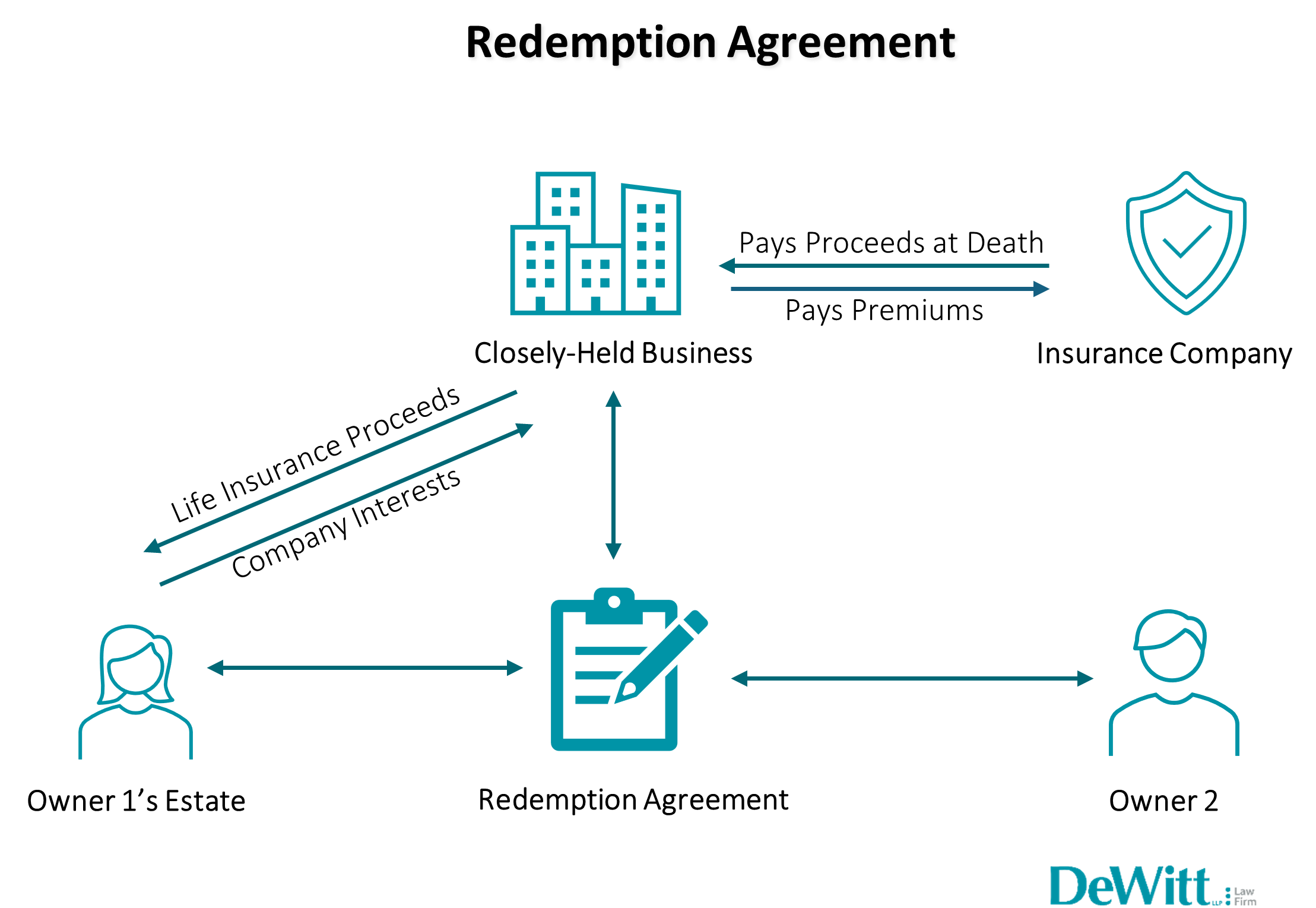

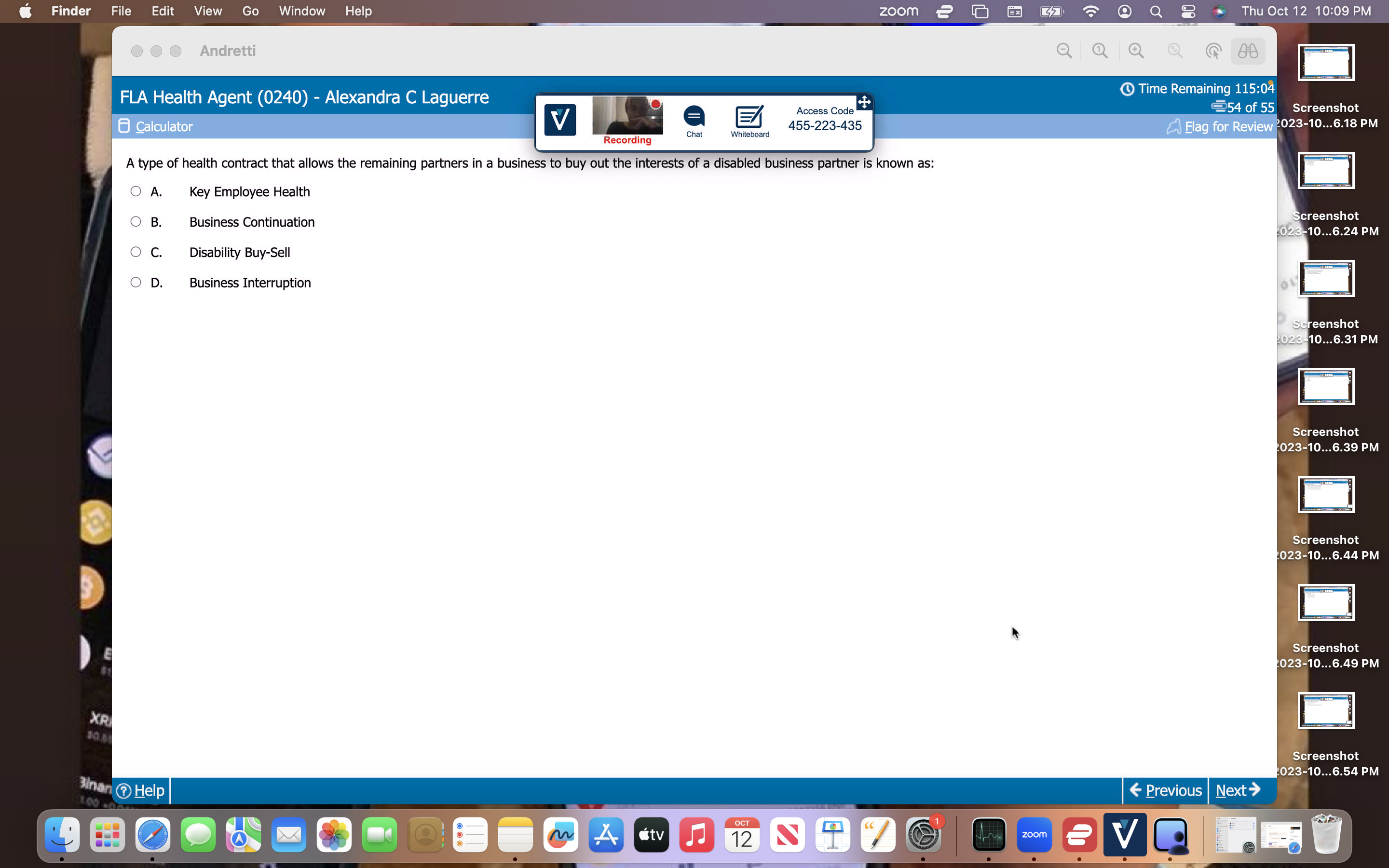

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Flamm Funeral Home Obituaries Rexburg

- The Rant Sanford North Carolina

- Blonde Underneath

- Demi Rose Thong

- Dearman Funeral Home Monticello Ar

- Right2know Chattanooga Mugshots

- Obituary Texarkana

- Now Hiring Forklift

- Morning Shifts Jobs Near Me

- Myreadingmanga Western

- Craigslist Mn Pets Anoka

- Njguns

- Orlando Rub Ratings

- Hartford Courant Obituaries Past 30 Days

- Jobs In Glendale Az Craigslist

Trending Keywords

- Bellingham Herald Obituaries Past 3 Days

- Smartsquare Wellstar

- Polk County Arrests Des Moines Iowa

- St Tammany Parish Inmate Search

- Flamm Funeral Home Obituaries Rexburg

- The Rant Sanford North Carolina

- Blonde Underneath

- Demi Rose Thong

- Dearman Funeral Home Monticello Ar

- Right2know Chattanooga Mugshots

Recent Search

- San Diego Rubmaps

- Math 20b Ucsd

- Daddy Dinar

- Flyertalk Delta Amex Credit

- Wgu D361

- Times Online Obituaries Beaver County

- Boston Globe Death By Town Today

- Emiru With No Makeup

- Accident On I 89 Vermont Today

- Modern Urgent Care Modesto

- Fbb Brazilian

- Who Got Busted In Abilene Texas

- Bellingham Herald Obituaries Past 3 Days

- Smartsquare Wellstar

- Polk County Arrests Des Moines Iowa

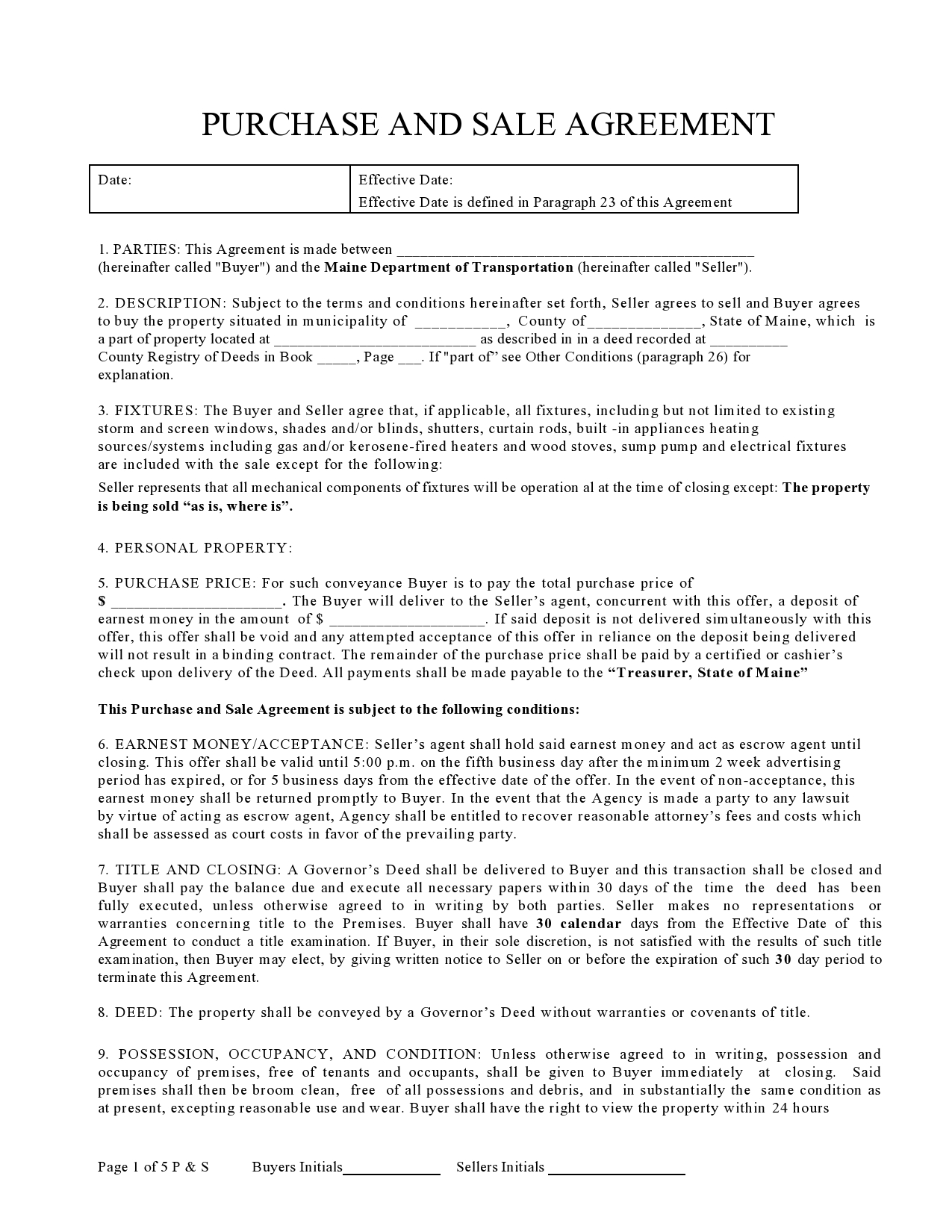

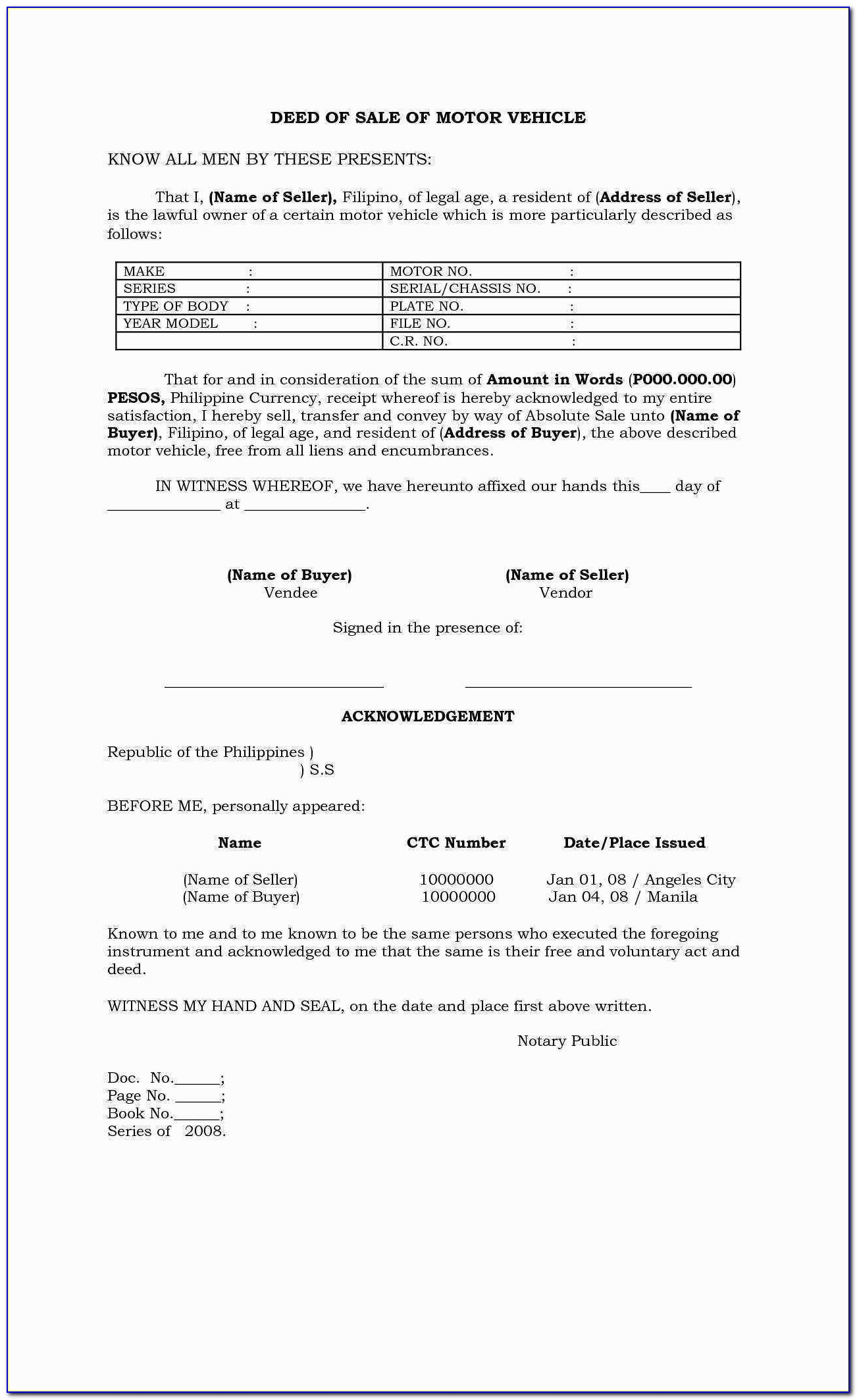

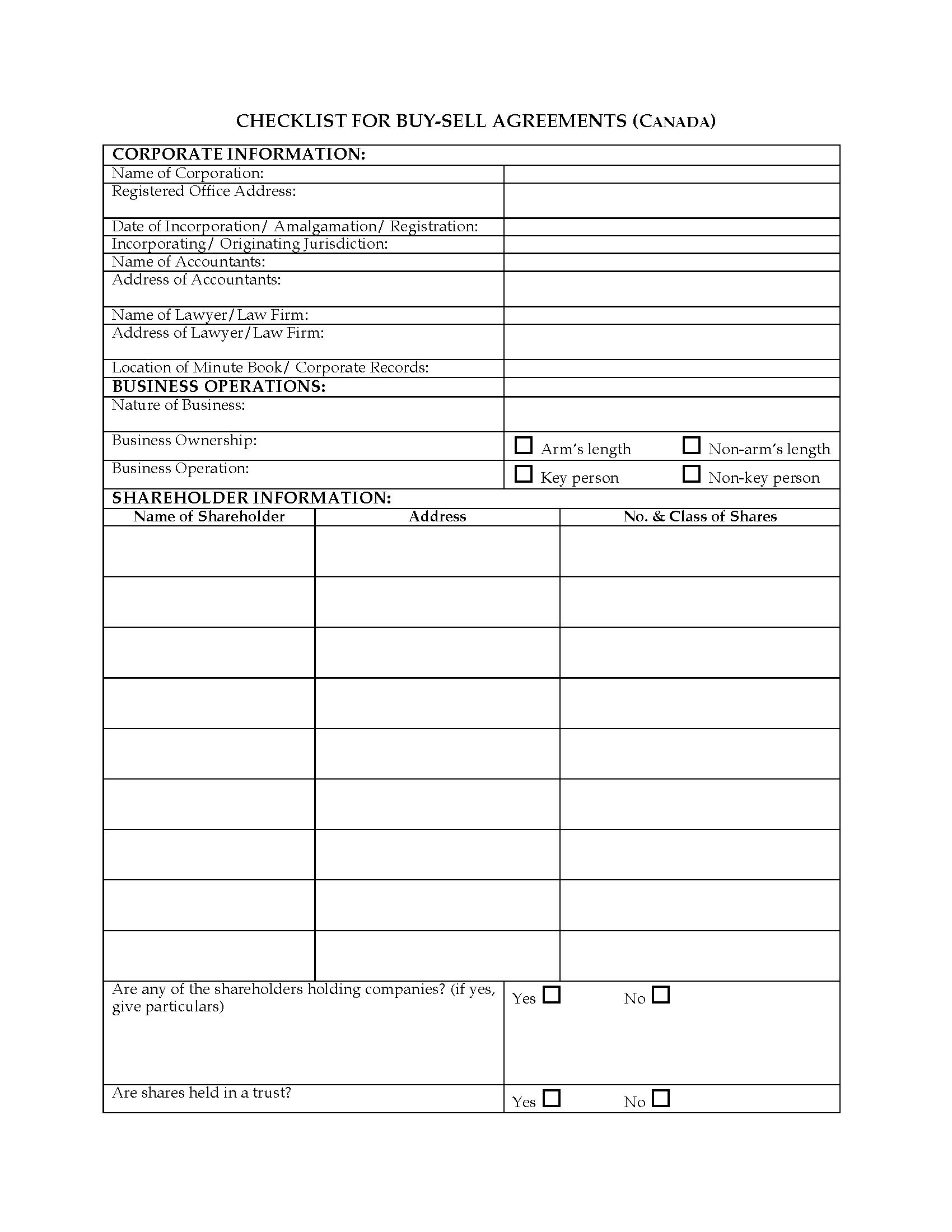

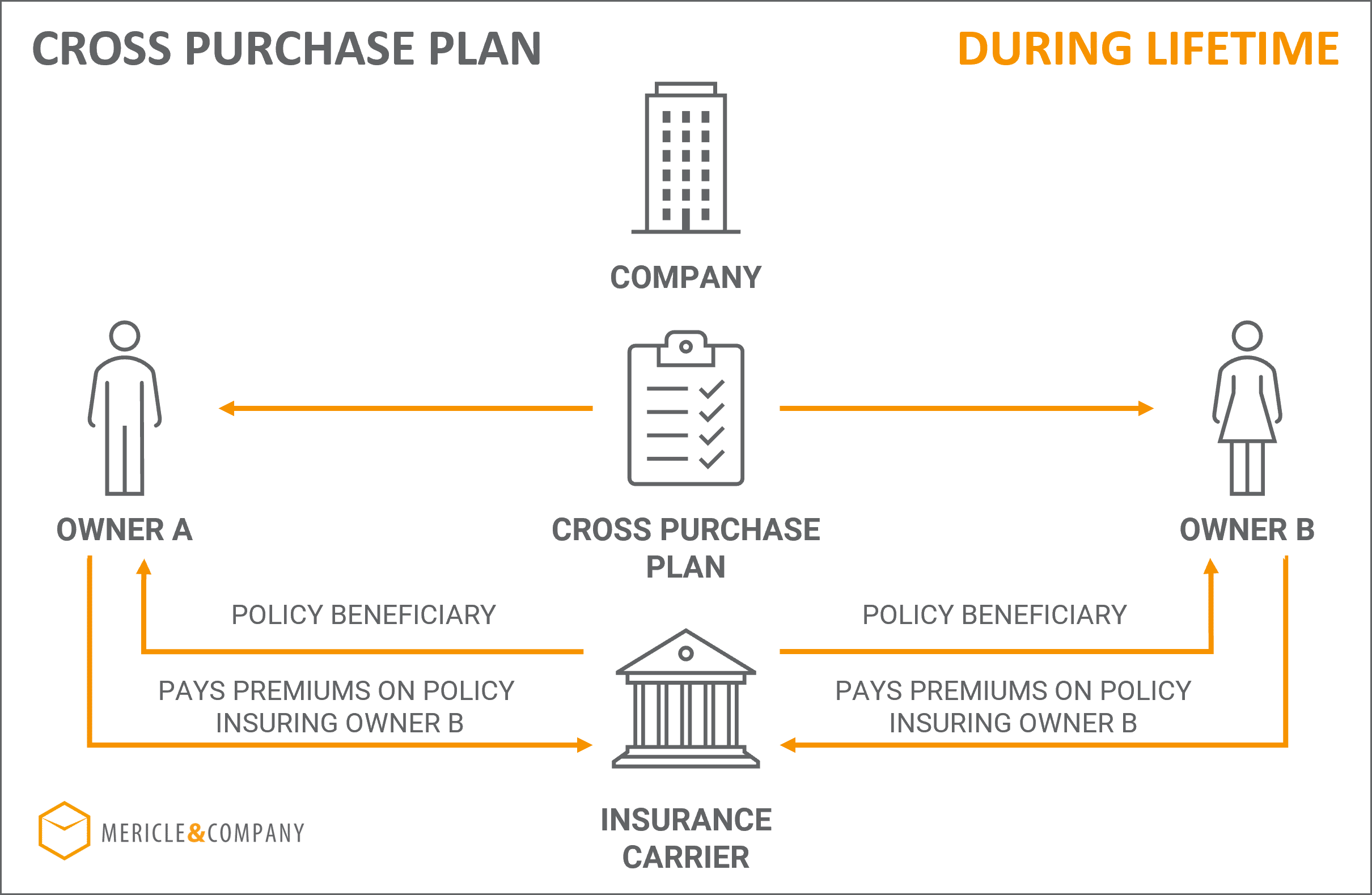

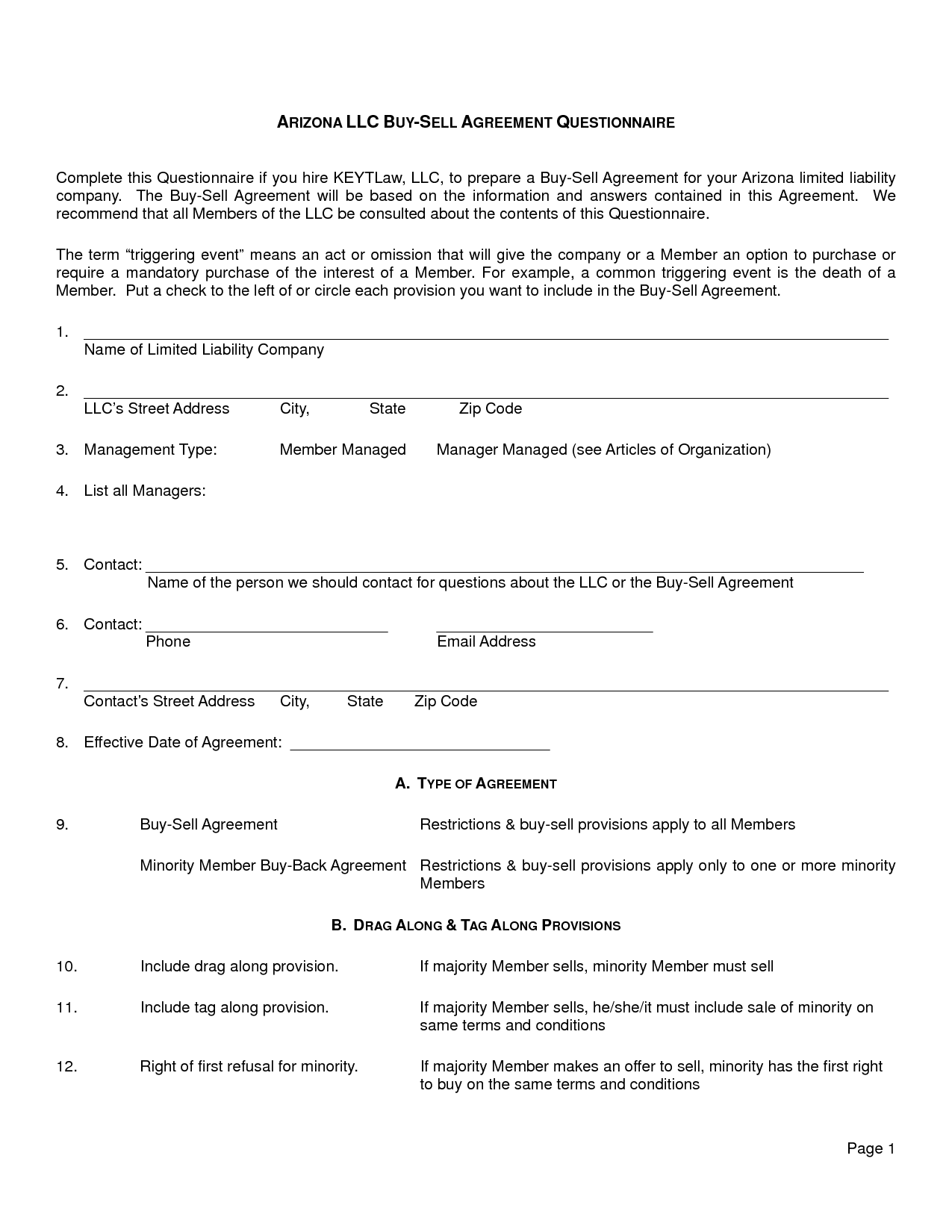

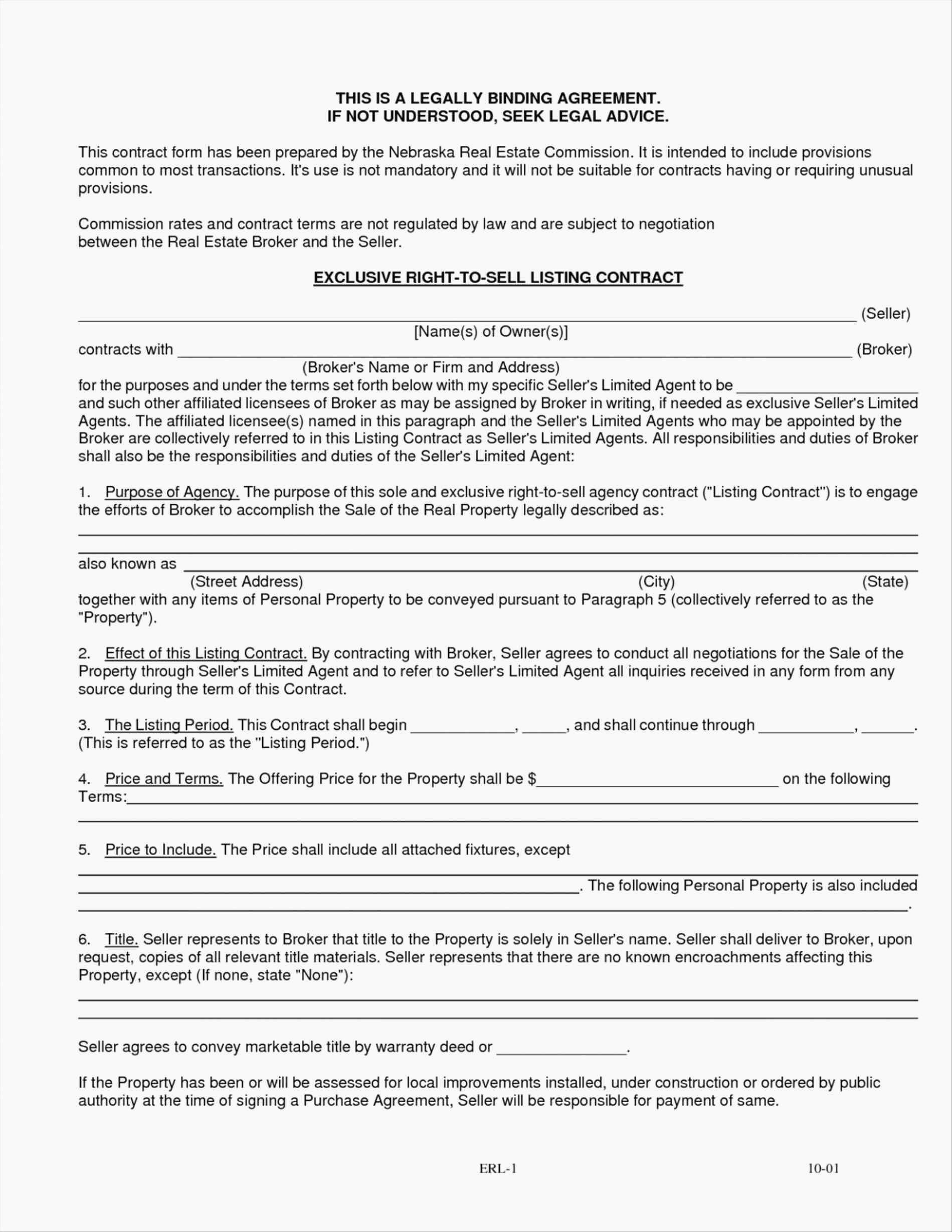

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)